A new decade has dawned and the MinerUpdate.com team wishes all of our subscribed miners a happy halving year! MinerUpdate launched in April 2019 and a lot has happened since we began our mission of delivering high-quality news and research to the mining world. We have met with a huge variety of miners from all over the globe and launched our inaugural MinerSummit event in Chengdu. We are grateful for all of the miners who have tuned into our content and we will certainly be delivering more high-quality events and content in 2020!

Don’t miss the latest developments and insights taking place in the mining world. Join the MinerMovements mailing list.

Mining Pool Rankings

Data from BTC.com highlights that after the first week of Bitcoin mining in 2020, the dominant pools of 2019 – Poolin, F2Pool, and BTC.com – remain in the top three positions. Collectively, these three pools are estimated to account for over 45% of Bitcoin hash rate.

Bitcoin Hash Rate & Difficulty Level

Data from Bitinfocharts estimates that Bitcoin hash rate has hit an all-time high in 2020. The seven-day moving average of hash rate illustrated above is currently recording a value of 108 EH/s. Raw values from Bitinfocharts have recorded hash rate figures as high as 117 EH/s.

Bitcoin mining difficulty is also at all-time highs at 13.79 trillion after it’s the latest adjustment on New Year’s Day. The difficulty level is currently estimated to increase another ~8.78% to 15 trillion at the next adjustment in six days based on analysis of block times by BTC.com.

Some miners have reported to us that S9-generation hardware accounts for over half of the Bitcoin hash rate. At current prices, most mining operations running such hardware will be forced to shut down. Several Chinese mining operations have also reported transitioning this generation of mining rigs overseas to regions such as Kazakhstan and Iran with lower electricity rates. If price levels remain around current prices beyond the halving, a significant drop in hash rate may be observed if large volumes of this generation of hardware cannot be migrated to regions with lower levels of electricity rate.

Bitcoin Price

After three price declines to sub-$7k, bitcoin price has recorded strong upside movements on it’s latest return above $7k. Bitcoin price has recorded a 15% appreciation open-to-high over the past three trading days with price trading at $8,274 at the time of writing. If the price appreciation is sustained, it may spur further increases in hash rate and difficulty. There is potential that mining rigs which may have been turned offline during the Q4 bitcoin price depreciation could be turned back online.

Miner Insights-

Dominant Theories as Bitcoin Halving 2020 Approaches - MinerUpdate explores the dominant theories relating to how Bitcoin price and fees will react to the 2020 halving. Increases in fees and bitcoin price are two methods by which bitcoin miners can be compensated for declining block subsidies but evidence supporting increases is far from certain.

Ethereum Muir Glacier Upgrade - Ethereum completes its second hard fork upgrade in less than 30 days to address mining difficulty levels rising faster than originally anticipated. In this piece, we detail what the Ethereum difficulty bomb is, what the Ethereum Ice Age is, and why the Ethereum core dev team decided to execute another hard fork to delay the onset of the difficulty bomb taking place.

Quick Miner Movements -

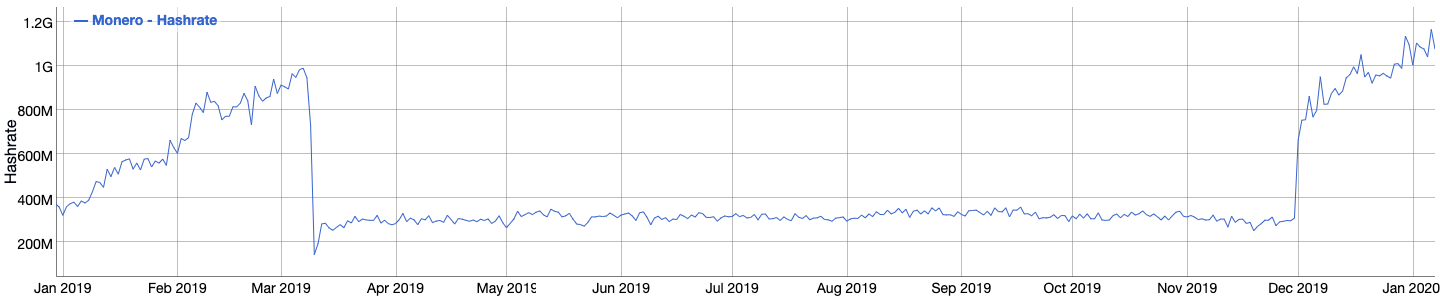

Monero hash rate has recently recorded all-time highs of roughly 1.16 GH/s. Monero recently changed its mining algorithm to RandomX in a network upgrade.

Ethereum block times reduced by roughly 25% post-upgrade. With the Muir Glacier upgrade resulting in lower mining difficulty levels on the Ethereum network, the block times reduced from an average daily block time of 17.16 seconds on January 1st to approximately 13 seconds since January 3rd.

Bitmain Slash Staff - It is reported that Bitmain has laid off half of their workforce. The 2020 halving and it’s expected negative impact on the Bitcoin mining industry is being spread as the reason for the major layoff. However, one miner we spoke with offered an alternative explanation. He held that Bitmain is likely facing issues given developments over the past two years and the halving offers the perfect time to lay off large amounts of staff.

Best of the Rest

Bitcoin’s Production Cost - Charles Edwards of Capriole Investments explores the highly debated topic of whether the cost of production Bitcoin miners incur per bitcoin mined acts as a price floor for market movements. Edwards finds evidence that the electricity cost of production per bitcoin mined acts as a price floor for market price movements with bitcoin price historically falling below total production cost for only brief spells of time. Data from the Cambridge Bitcoin Electricity Consumption Index is used to estimate the electricity production cost and total production cost.

Bitcoin Energy Value Equivalence - Charles Edwards of Capriole Investments builds upon his cost of production work to propose a relationship between Bitcoin value and the energy input into the network. One of the key findings of the research argues that if the energy put into the Bitcoin network drops to zero, value would follow. Such an observation is interesting given the hype that the price to scarcity (stock-to-flow) model has generated over the past year. The findings of this study highlight that the relationship between scarcity and price should not be considered in isolation and it is highly likely that energy also closely ties to value.

What’s Halvening #4 - Cassie Clifton hosts CoinShares Director of Research Chris Bendiksen who covers the key findings of the recently published CoinShares Bitcoin mining research report. Chris anticipates that at current prices, the hash rate behind the Bitcoin network would drop by 50% after the halving. Prices would need to double for the hash rate to remain at current levels according to Chris. This episode is also a great discussion for gaining a deeper understanding of how upfront capital expenditure costs relate to mining operations. Chris clearly differentiates between all-in ROI breakeven and cash flow breakeven, explaining why miners are only forced to shut down when prices drop below cash flow breakeven.

About MinerUpdate.com

MinerUpdate.com is the leading crypto-mining publication. Our aim is to bridge the gap between the East to the West in mining while delivering to our readers the latest insights and developments in the industry. Our publication is ad-free, bias-free, with no conflict of interest when it comes to delivering high-quality content. In October 2019, MinerUpdate hosted MinerSummit, the first English crypto mining event in China.

Connect With Us

Did we miss any important mining movements? Let us know by tweeting @MinerUpdate or emailing hi@minerupdate.com.