Amid extraordinary stimulus measures from the biggest central banks, equities have been increasing. Bitcoin price has also been increasing since phenomenal declines in March, resulting in miner margins widening. The below price chart illustrates how events have unfolded with difficulty. A combination of prices increasing and difficulty undergoing its second-largest downward adjustment provided miners with a lucrative two weeks. Estimates for miner profitability over this period ranged from $0.103 to $0.152 daily per TH deployed. In the timeframe beforehand since the March 12th price depreciation, profitability estimates were $0.069 to $0.108. Prices have since continued to increase while difficulty also adjusted upward by 5.77% on the 8th of April.

Price and difficulty are both important for miners. But with miners earning the lions share of their revenue from the Bitcoin block subsidy, the halving is an event which will have a significant impact on the entire Bitcoin ecosystem. At the time of writing, the Bitcoin halving is 33 days away. The Bitcoin Cash halving occurred over the past 24 hours while the Bitcoin Cash SV halving is scheduled to take place within the next 24 hours. This week’s MinerMovements cover piece focuses on what has been the most discussed event among Bitcoin miners for the past year.

Special thanks to Braiins / Slush Pool for sponsoring this newsletter! Check out their new autotuning firmware to boost your S9's hash rate and efficiency by up to 30% and get 50% lower pool fees if you mine on their pool. (S17 & T17 coming in Q2).

Halving, Antminer S9 Obsolesence, & Miner Capitulation

Encoded in the Bitcoin protocol is a reduction in the block subsidy every 210,000 blocks (roughly four years). With the subsidy typically accounting for >98% of miners revenue, the event is of significant importance to every stakeholder in the network.

The Bitcoin Security Budget

Miners invest billions of capital into hardware, facilities, power, and labour with the aim to ROI on their capital. The money miners invest in the network can largely be considered the network’s security budget.

If this capital is not put to use for the purpose of appending blocks in the Bitcoin blockchain, the security budget is effectively reduced. Reduction in the security budget impacts practically every stakeholder in the network – holders, exchanges, businesses, developers etc.

Long-Term Bitcoin Security - How Will Miners Be Compensated for Revenue Reduction?

Increases in transaction fees or price are the two ways miners can be compensated for the decline in block subsidy. While many hold hopes for transaction fees rising over the long-term to compensate, there has been very little to back this up apart from increases observed to date in transaction fees as percentage of total rewards.

Industry professionals have noted concern for Bitcoins security long-term as the block subsidy continues to decline. Braiins co-CEO Pavel Moravec doesn’t see the subsidy declining as an issue in the short-run but is unsure how the dynamics will play out in the long-run.

“In the long-run, I am slightly concerned. I don’t know how the economics will play out. I don’t see it as a problem in the short-term. It should not be an issue over the next two halvings.” Pavel Moravec

Bitcoin developers also don’t have the answers. At an event in February, Soona Amhaz asked a panel “once we can’t depend on block rewards as a sort of incentivization for miners, will transaction fees be enough?”.

“This is the hardest question you can ask about Bitcoin. We hope so. It’s really hard to know” Tadge Dryja

Halving & Price

The halving acting as a catalyst for price increases in Bitcoin is another widely discussed topic. While price did increase in the lead-up to the first two Bitcoin halving events, the lead-up to this third halving has demonstrated that bullish price increases as a result of halving events are anything but guaranteed.

The post-halving $55k forecast derived from Plan B’s Stock-to-Flow model has likely been the most widely circulated price prediction. However, there have been countless criticisms of the model including a recent comment from Nic Carter.

“I make no secret of the fact that I’m skeptical of the model. I don’t believe issuance changes represent new information being brought to market, so treating them as if they are information shocks seems incoherent.” Nic Carter

Similar to transaction fees, there are no guarantees regarding how Bitcoin price will behave in relation to its supply issuance halving. Furthermore, this information has been publicly known from the inception of the network.

Halving Simulation & Antminer S9 Obsolesence

In the >50% March BTC price decline, we saw somewhat of a halving simulation. Bitcoin price depreciated by over half its value in the course of two days, bringing roughly 16% of the network below cash flow breakeven levels.

With the price drop, the inefficient miners who were lowest on the cost curve became unprofitable and were forced to sell all of the coins they generated while also depleting treasury reserves. They eventually reach the point of capitulation where they are forced to turn off their equipment.

The halving will effectively repeat this process unless prices can rise in the meantime. Miners will struggle directly after the halving but the difficulty will ultimately adjust and those efficient miners that remain will receive the rewards which were previously distributed to those lower on the cost curve. Recent research from Blockware Solutions presents data that argues that this results in favourable market dynamics. As inefficient miners are removed, those efficient miners that remain have healthier balance sheets and need to sell less of their generated BTC in order to meet fiat-denominated costs.

Another impact of the halving is the obsolescence of old hardware. The Antminer S9, a rig which has been widely used by miners since its launch in May 2016, will likely only be able to mine in regions where electricity rates can be secured at <$0.01. Anecdotal reports in the last quarter of 2019 noted the transition of Antminer S9 rigs from China to regions in Kazakhstan and Iran where cheap coal-power agreements can be secured. Recent Bitcoin nonce distribution analysis has highlighted that large amounts of S9 mining rigs have likely already been turned offline.

Halving Predictions…

The halving has been surrounded by predictions, projections, and forecasts. The spread of COVID-19 demonstrates the futileness of forecasting uncertain variables. Envision how many five-year business plans took into consideration the possibility of a pandemic which would bring the business world the standstill.

Therefore, predictions relating to price and transaction fees should all be considered extremely speculative. Less speculative is the fact that the mining industry as a whole operates just above the margin. While a significant percentage of inefficient miners were removed as a result of the March declines, some of these will have reentered given the recent price increases. However, the halving will be another event which will put severe pressure on miners. At current prices, a myriad miners operating with high electricity costs and old-generation equipment will be pushed below their breakevens and those most efficient miners will be strongly positioned to receive their rewards when difficulty adjusts to reflect the mass removal.

Get the latest insights in the mining world. Join the MinerMovements mailing list.

Quick Miner Movements;

Largest US Ethereum miner CoreWeave redirects computing power at distributed network aimed at finding a therapy for Coronavirus

Publicly listed Ethereum mining firm Hive Technologies acquires 30 MW Bitcoin mining facility from Cryptologic for $4 million. At current estimates of Bitcoin energy draw, a 30 MW farm would represent roughly 0.3% of Bitcoin network hash rate.

CME Director’s board of directors nominee proposes that the CME Group begin Bitcoin mining as a new revenue stream for shareholders.

Best of the Rest:

Hashr8 Podcast - Matthew D’Souza: Bitcoin Mining & Macro Trends - Blockware Solutions CEO Matt D’Souza joins the Hashr8 crew for an informative episode which details the recent research released by Blockware that highlights cycles of miner capitulation. Matt also shares his views on recent macroeconomic developments and what it may mean for Bitcoin.

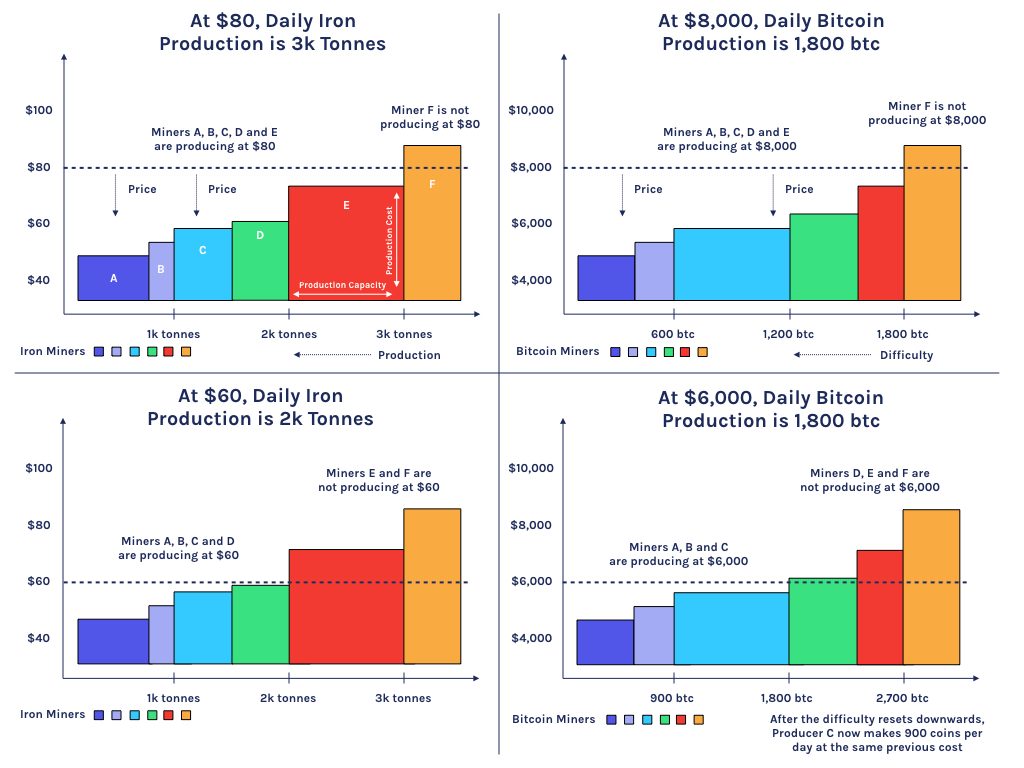

Why Bitcoin Miners Will Keep Mining - CoinShares Head of Research Chris Bendiksen details how the cost miners incur is a function of difficulty. The difficulty adjustment mechanism is in place to keep production in Bitcoin constant. If price falls 10% in a commodity such as iron, you can expect production to drop. However, if price falls 10% in Bitcoin, the difficulty will adjust to keep production constant while the reward which was previously going to miners operating just above the margin are distributed to more efficient miners. Chris illustrates the idea succinctly with the below diagrams.

Coin Metrics’ State of the Network: Issue 44 - CoinMetrics proposes a framework which highlights miners having a “pro-cyclical” impact on Bitcoin prices. When prices are high, miners are required to sell less of their generated BTC to meet fiat-denominated costs and vice-versa. The team anticipates profit margins for miners continuing to be squeezed, increased selling, capitulation, and removal of the most inefficient miners from the network.

CoinMetrics’ State of the Network: Issue 45 - Until recently, Antminer S9 mining rigs have represented a dominant share of Bitcoin hash rate since their release in May 2016. Price declines and the upcoming halving are forcing S9 rigs offline. An analysis of the Bitcoin nonce distribution shows the disappearance of a mysterious pattern which originally arose when the Antminer S7 and S9 began mining. The disappearance of this pattern suggests that increasing numbers of S9 rigs are beginning to turn offline, with the Antminer S17 series becoming the dominant ASIC.

Once again, a big thanks to Braiins / Slush Pool for sponsoring this newsletter! Check out their new autotuning firmware to boost your S9's hash rate and efficiency by up to 30% and get 50% lower pool fees if you mine on their pool. (S17 & T17 coming in Q2).

About MinerUpdate.com

MinerUpdate.com is the leading crypto-mining publication. Our aim is to bridge the gap between the East to the West in mining while delivering to our readers the latest insights and developments in the industry. In October 2019, MinerUpdate hosted MinerSummit, the first English crypto mining event in China.

Connect With Us

Did we miss any important mining movements? Let us know by tweeting @MinerUpdate or emailing hi@minerupdate.com.